Key Points

- Debt parking is the practice of reporting accounts to your credit file prior to notifying you.

- Companies use debt parking to force payment on accounts even if you do not owe the money.

- You can be proactive to protect yourself from the practice of debt parking.

Applying for a new loan, you face a surprise denial after the company reviews your credit. What happened? After a little digging, you discover a debt on your credit report that you do not owe. It could be that you already paid it off, it was part of a previous bankruptcy filing, or the account belongs to a completely different person.

Regardless of the case, it is ruining your credit and preventing you from getting the loan.

Debt parking could be the cause.

What is Debt Parking?

Debt parking occurs when a company reports a delinquent account to the credit bureaus before notifying you. The record might remain on your file until you discover the error during the application process.

The creditor hopes that when you discover the debt, desperate to get the matter resolved, you will pay the bill even if you don’t legally owe the money.

Is Debt Parking Legal?

No. The practice violates the FDCPA (Fair Debt Collection Practices Act), which requires companies to notify you BEFORE reporting any debt to the credit bureaus. You have 30 days to dispute the validity of the debt. When companies bypass this process, you could end up with inaccurate or fraudulent debts on your credit file, negatively affecting your score.

Inaccurate reporting of debt can be a major problem because purchased debt often contains errors. Without the opportunity to rectify the inaccuracy, the delinquent debt could damage your credit without your knowledge.

FTC Pursuing Debt Collectors Who Practice Debt Parking

Recently, the FTC (Federal Trade Commission) settled the first fraud case involving debt parking. The settlement involved Midwest Recovery Systems, which listed bogus or highly questionable accounts on thousands of credit reports. Many of the debts involved unresolved fraud claims or rebilled medical debt previously paid by insurance. The company collected more than $24 million from consumers, even though 80 to 97 percent of the obligations were considered invalid or inaccurate.

What Are Your Rights When a Company Parks Debt on Your Credit Report?

If you become a victim of debt parking, you could sue the company for violating FDCPA laws. However, many consumers do not have the financial means to take the matter to court.

You can immediately dispute the record with the credit bureau to get the item removed. Credit bureaus must investigate all disputes and correct errors. Filing a complaint with the FTC could also result in an investigation against a specific company if the agency receives a large number of complaints.

Retaining records of paid off accounts, settled debt, bankruptcy paperwork, and insurance claims can provide the supporting documentation needed to correct your credit file without legal action.

How to Protect Your Credit Against Debt Parking

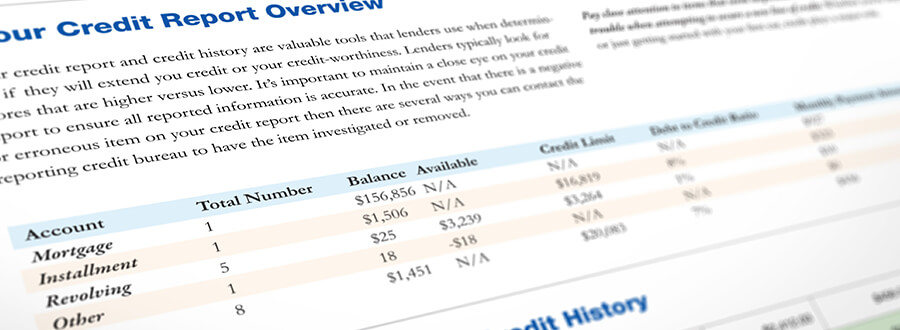

Monitor your credit file. You can get a free credit report from each of the three major credit bureaus once every 12 months, or if you experience fraud, at www.annualcreditreport.com. Companies like Credit Karma also provides access to your Transunion credit file without charge.

Monitoring your credit report can allow you to identify mistakes or errors on your report, as well as the reporting of any account prior to the debt collection agency notifying you about the debt.

Monitoring your credit score could alert you to a change in your credit file. If your score suddenly drops, without explanation, you can review your credit report to identify the new activity that lowered your score.

Waiting to review credit until you have applied for a loan, insurance, home, or job could put you in a precarious situation because, in most cases, you must clear up the issue before loan approval.